Driver 5: Financial sustainability

As a self-funded organisation, our financial sustainability is of utmost importance. It is a prerequisite for the future of the EPO and directly related to our ability to have a positive impact on the patent system and society.

Under Strategic Plan 2028 (SP2028), we will safeguard the EPO’s financial sustainability in uncertain times by monitoring the coverage of our liabilities and implementing measures to improve them.

- Towards financial sustainability in SP2023

-

To achieve financial sustainability in a changing world, an organisation must first understand its current financial situation and then act effectively armed with that insight. So, in 2019, the Office commissioned independent experts to undertake a first financial study to assess the EPO's long-term financial situation. On the basis of a base case scenario, the study identified a funding gap of EUR 5.8 billion set to emerge over the next 20 years, meaning the EPO would not be able to cover its liabilities in the future without any additional measures.

To address this gap, our Office developed six financial measures based on the six principles of transparency, proportionality and fairness, shared effort among all stakeholders, affordability, reversibility and gradual implementation.

The package of measures was adopted by the EPO's Administrative Council in June 2020 and represented a joint commitment to the different stakeholders for securing the long-term financial sustainability of the Organisation.

- Evaluating current progress

-

As the end of the Strategic Plan 2023 (SP2023) drew near, the Office commissioned a further independent financial study to evaluate the impact of the measures implemented since 2020.

Overall, the study found that the EPO's situation had evolved in four different ways: there had been a return to a positive interest rate environment driven by higher inflation; there was GDP growth in most relevant jurisdictions despite the pandemic; along with steadily growing incoming workload, there was an increase in search and examination stock while timeliness targets were met; and the bundle of financial measures had been introduced successfully since 2020.

Fundamentally, the as-is analysis found that the bundle of financial measures implemented since 2020 have had a positive impact on the EPO's financial situation. Specifically, a total impact of EUR 1 102m was observed as of 2022 on the Office's equity,10 as opposed to the EUR 719m predicted in the 2019 financial study. Furthermore, a total impact of EUR 574m was observed on the Office's operating result from 2018 to 2022, as opposed to the EUR 31m predicted.

- Looking to the future

-

With substantial progress made under SP2023, the latest financial study also equips our Office with a picture of how the EPO's finances are set to evolve in the future. Our long-term financial sustainability has been assessed, taking due account of developments in the technological and financial landscapes that have occurred since 2019 – especially in the light of the high levels of inflation.

Fundamentally, the study found that the EPO's finances are projected to evolve positively. Using the base case scenario, the EPO is expected to achieve a more positive outlook over the next 20 years. By 2042, it is expected that the funding requirement of the Office will be EUR 1.7bn while the available cash surplus is expected to be EUR 5.9bn, resulting in an overall coverage surplus of EUR 4.2bn.

Notably, the measure on salary adjustment has contributed EUR 1.8bn in the middle scenario to improving the funding requirements. This means that without the salary adjustment the overall funding requirements of the Office would have been EUR 3.5bn instead of EUR 1.7bn. Additionally, the salary adjustment method has increased the cash available by EUR 0.7bn. Digitalisation has improved the cash position of the Office by EUR 1.3bn in the middle scenario for future coverage. Without this measure, the Office's available cash would have amounted to EUR 4.6bn instead of EUR 5.9bn.

- Achieving financial sustainability and resilience

-

Our road to financial sustainability is also a journey to financial resilience. The EPO must continue to make progress on the factors that we can control so that we can still achieve financial sustainability even in the face of any unexpected economic shocks or negative external influences. This can only be achieved by increasing productivity, planning well our production, protecting our vulnerabilities by introducing a better risk management approach and incorporating an economic buffer into our projections for achieving financial sustainability. For the latter, our positive operating result surplus will be the first resource.

KPI targets

2.1% average productivity increase per year

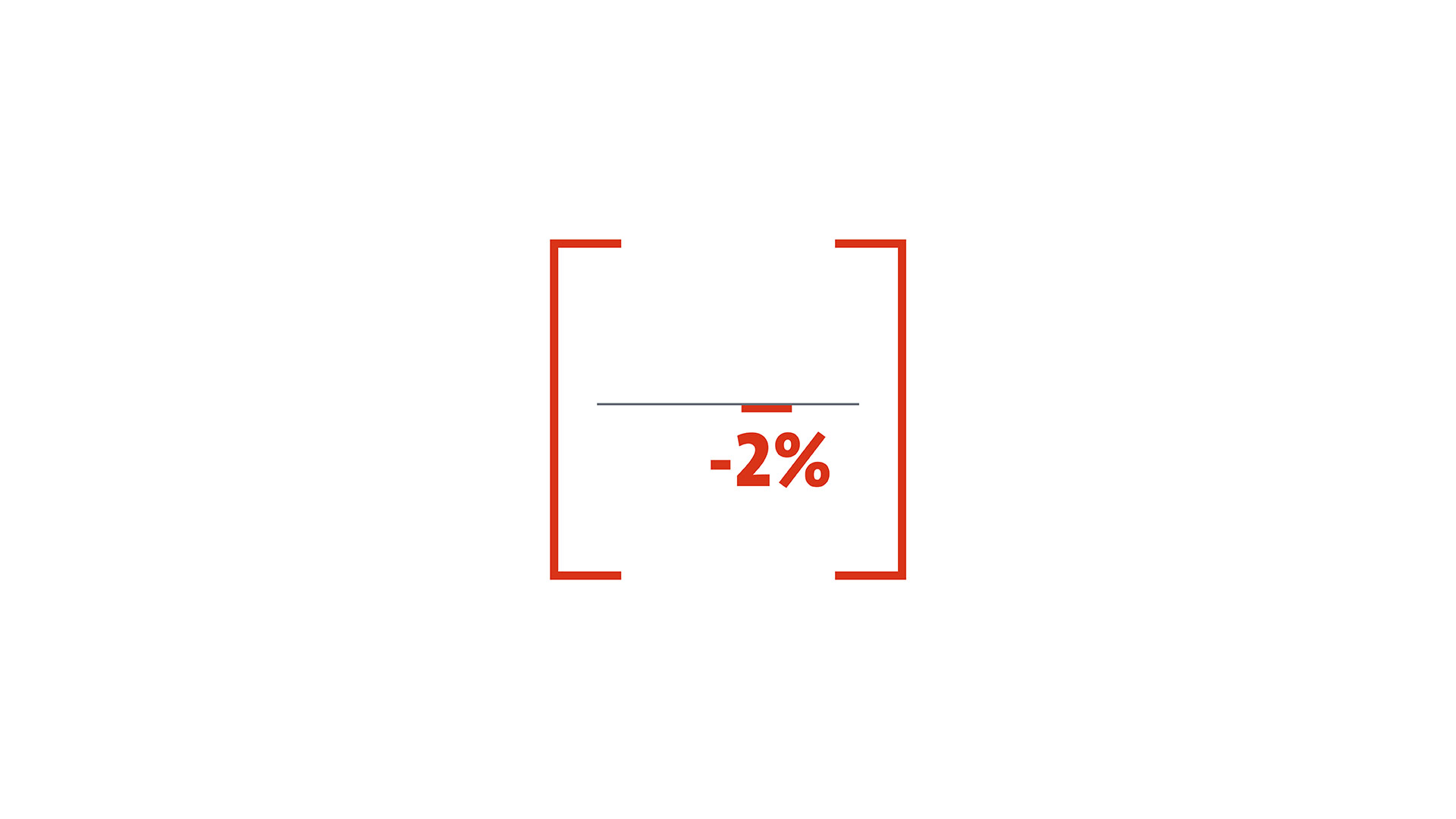

Maintain the negative deviation from our annual production target at no more than -2%

Continually reduce the percentage of our unfunded liabilities based on the risk analysis

Coverage gap/surplus, recalibrated to account for the findings of the new financial study